The “DSO model” specifically mentioned in the prospectus of Arrail Group has officially launched.

On November 3, Arrail Group disclosed on the Hong Kong Stock Exchange that it has partnered with Jarvis Medical Technologies (Jarvis) to launch a digital DSO (DDSO) project – “FRIDAY”. Leveraging Arrail Group’s more than 20 years of industry experience and Jarvis’s digital capabilities, FRIDAY will empower small and medium-sized dental clinics, especially in lower-tier cities, with medical know-how, elevated service standards, and data-driven management decision-making.

According to Arrail and Jarvis, although a handful of large national chain brands have emerged in the PRC dental service market in recent years, individual dental clinics and small dental chains still account for the lion’s share of the market, and new entrances of entrepreneur dentists will keep the market fragmented in the medium term.

However, the development of standalone clinics and small chains, which account for a substantial portion of the PRC dental service market, is hindered by pain points such as insufficient medical capabilities, increasing compliance risks, difficulty in customer acquisition, lack of sales capability, lack of financial management capability, etc.

As the first listed premium dental chain in China, Arrail Group not only has the largest market share in the premium dental service market, but also rank as one of the highest revenue-grossing companies in the entire private dental service market. (Source: Frost & Sullivan, data for 2020) Its more than 20 years of excellence in medical know-how, operation management, and customer service in the dental service market is of great aspiration to other clinics and dentists in the industry.

Jarvis started as B2B supply chain solution provider for medical supplies, before expanding to clinical costs management system, e-learning system, and other digital services supporting nearly 50000 SME dental clinics. Jarvis not only brings strong supply chain and digital capabilities to FRIDAY, but also brings access to a vast number of SME clinics in lower-tier cities.

From “riding the market” to rational investment, China’s dental service market is still far from saturation and will continue to grow

In a previous conversation between vcbeat.net(动脉网)and Robert Zou, founder of Arrail Group, Mr. Zou pointed to two important inflection points in the development of the PRC private dental service industry. The first wave, driven by regulatory reform in the 2000s, stimulated China’s private-sector investments in dental service. The second wave was driven by social wealth. In 2019, China’s per capita GDP exceeded $10,000 dollars, and the public’s demand for oral health care reached a tipping point, ushering in a golden period of development in the dental service industry in China.

According to Frost & Sullivan Report, from 2015 to 2020, the size of private dental service market in China increased from RMB 43.3 billion to RMB 83.1 billion, with a CAGR of 13.9%, and the size of the premium private dental service market also increased from RMB 1.3 billion to RMB 2.6 billion, with a CAGR of 15.2%.

With the rapid market growth, the number of private dental hospitals has also been increasing. According to the China Health Statistics Yearbook, from 2007 to 2019, the number of private dental hospitals in China increased from 103 to 723, representing a seven-fold increase. China’s private dental service market not only achieved rapid growth both in terms of market size and number of institutions, but also welcomed a new development – large dental service chains. National and regional dental chains such as TC Medical, Arrail Group and Delun Dental Clinic also entered a period of rapid expansion.

However, the market is still extremely fragmented with over 100,000 SME clinics. Thanks to the low capital requirement for opening a dental clinic, it is common to run a small clinic with 1 dentist operating independently, or 2-4 dentists banding together to run a small practice. In addition, since few dentists could acquire the necessary business skills to manage a corporation, successful multi-clinic chains are quite rare.

In recent years, we have seen a slowing down of capital investment, some of which can be attributed to the COVID-19 pandemic. Large dental chains have experienced slower growth and many small and medium dental clinics have also struggled. But in the view of Gina Zou, Jarvis’ founder and CEO, the fundamentals of the industry are still extremely strong. According to Ms. Zou, there are two major drivers for continuous growth. Firstly, demand for better oral health care exploded after the economic boom, and will continue to grow as life expectancy and health awareness increase. Secondly, there is still a significant supply shortage for dental services, due to the number of years required to train a qualified dentist. As Ms. Zou puts it, (the dental industry) is still decades away from perfect competition.

On the macro level, strong industry growth momentum means that dental service market is full of opportunities; at the micro level, however, dental service institutions are facing challenges from more stringent regulation, more competition in talent, more demanding customers, and a greater focus on the bottom line. Among them, dentist-run SME clinics are more vulnerable, and need third-party management support from the professionals - that is, DSO (Dental Support Organization).

DSO is a general term for operation management organizations or enterprises that provide non-clinical business support to dentists and clinics, so that dentists can focus more on clinical work. Services often include clinical management systems, clinical training, marketing, call center, finance and accounting, legal compliance, etc.

DSO originated in the United States and is growing rapidly. As of April, 2021, there are more than 10 DSOs in the United States. Heartland Dental, for instance, has amassed more than 1,600 dental clinics. In China, Arrail Group and Jarvis are among the firsts to build a national DSO network.

Unique and powerful partnership

Both partners of the FRIDAY DDSO project bring unique value to the table - Jarvis with direct access to 50,000 SME clinics, and Arrail with global-recognized industry know-how. Founded in 2016 by Gina Zou, a Wharton graduate, Jarvis is the only digital marketplace serving China’s dentists and suppliers. No matter how small the treatment, at least dozens of instruments and materials are required in any dental procedure. The complexity of managing these supplies created great burdens for both manufacturers and clinics. Jarvis’s online marketplace and digital supply chain solutions provide transparency, efficiency, and reduced costs for both upstream and downstream players. It now serves more than 50,000 SME clinics country-wide with over 1000 brands listed.

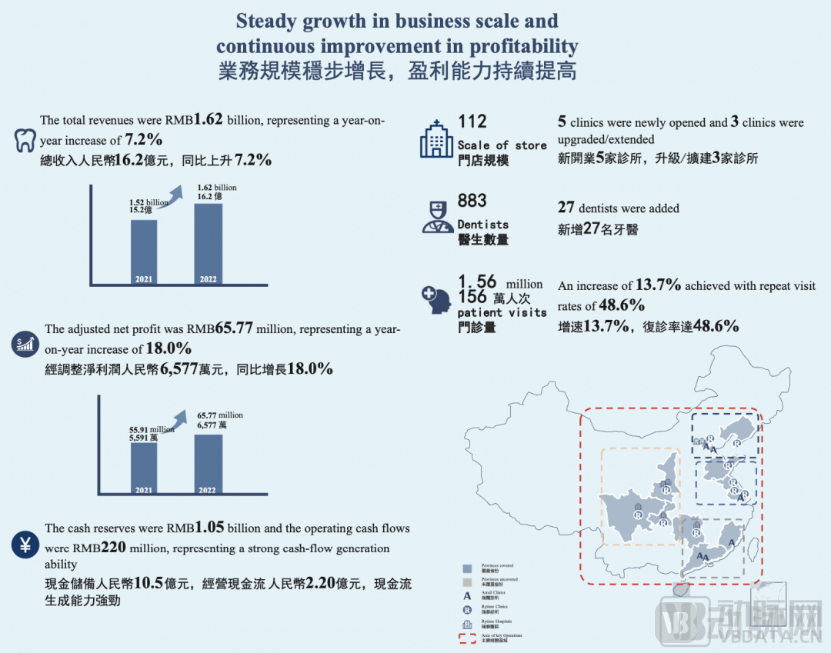

Arrail Group, as the first listed premium dental service chain in China, has 105 dental clinics and 7 hospitals in 15 cities, and 883 experienced dentists. With 23 years of successful operations and a revenue growth of 7.2%, the Arrail brand is one of the most influential among Chinese dentists. (Source: Annual Report 2021/2022 of Arrail Group)

Source: Annual Report 2021/2022 of Arrail Group

More importantly, as an early and successful entrant to the private dental service market in China, Arrail has gained a deep understanding of the issues faced by dental clinics, and key success factors to grow. With a nation-wide footprint, Arrail also has a firm grasp of market trends.

Arrail was founded on the premise of open competition and market development. It wanted to grow the dental service market and to help bring quality oral care to all market segments. It is now ready to service the vast fast growing lower-tier markets by empowering SME dentists through DDSO membership.

Digitalize market-proven industry solutions for SME dental clinics.

There are three main tenets to the empowerment FRIDAY brings to SME dental clinics: medical know-how, elevated service standards, and data-driven management decision-making.

First, the FRIDAY e-learning platform houses over 400 cross-functional online courses specifically tailored for dentists, medical, and operational staff. In addition, the dental team at Arrail Group can provide medical second opinion to SME dentists in remote cities through FRIDAY digital medical platform, empowering them to treat their patients with improved quality of care. According to the Annual Report 2021/2022 of Arrail Group, as of 31 March 2022, the total number of dentists in Arrail Group was 883, and over 50.1% of the full-time dentists had master’s degrees or above, and many held titles and qualifications as chief medical director or medical discipline leader. The entire team of dentists has an average of 10.6 years of post-qualification industry experience.

Secondly, FRIDAY clinical management system is powered by its trademarked “ArrailCare 5A” process. “ArrailCare 5A” is a unique service quality assurance system developed by Arrail Group through its 23-year-pursuit of service excellence. It breaks medical care into five touch points: “appointment”, “first visit”, “treatment”, “sendoff” and “continuous care” (“预”“首”“诊””末““延”), an algorithm will automatically send tasks at each touch point to appropriate staff based on treatment complexity and patient’s characteristics. FRIDAY’s medical module is equipped with a risk classification system of 142 treatments, ensuring medical experts can supervise appropriate cases and intervene at the right time. The FRIDAY system standardized and automated medical and service procedures in a revolutionary way, ensuring all dentists within the DDSO network can service their patients with the same level of excellence.

Last but not least, the most powerful tool FRIDAY offers is its state-of-the-art BI system. Over 400 operational and managerial indicators are constantly monitored at all levels to provide dentists executional and strategic level guidance. “Most dentists do not have professional business training. They do not know how to interpret the data nor what data to look for. FRIDAY’s BI is the fruit of 20 years of managerial experience by dentists for dentists, to guide them to capture the right data at the right growth stage and make the right decision.” Ms. Zou explained.

FRIDAY is a win-win solution. It allows SME dental clinics to tap on the deep experience and resources of market leader Arrail Group and allows Arrail to grow in tandem with the industry, capitalize on ample opportunities and room for growth in the lower-tier cities at faster speed and higher ROI. FRIDAY’s offering can help to improve the overall level of oral care, help clinics improve operational efficiency and effectiveness, lower costs, and gain more customers. The virtuous cycle will elevate the market and enable all players to realize the vast untapped potential in the domestic dental service market.